The Net-Zero Asset Owner Alliance, composed of 30 of the world’s largest investors representing $5 trillion in assets, has published for public consultation a protocol establishing five-year portfolio decarbonisation targets, consistent with a maximum temperature rise of 1.5°C above preindustrial levels.

Convened by the UN Environment Programme Finance Initiative (UNEP FI) and the Principles for Responsible Investment (PRI), the Net-Zero Asset Owner Alliance brings together institutional investors committed to transitioning their investment portfolios to net zero greenhouse gas (GHG) emissions by 2050 and to aligning them with the Intergovernmental Panel on Climate Change (IPCC) 1.5°C scenario.

The “Draft 2025 Target Setting Protocol” lays out plans for reducing emissions, increasing investment in the net zero emissions transition, and enhancing influence on markets and government policy. The protocol gives alliance members the flexibility to employ a combination of approaches to achieve their unique decarbonisation and engagement strategies.

Alliance members will set individual portfolio targets during the first quarter of 2021, resulting in emissions reductions between 16-29% per member by 2025 from 2019 levels. Targets are designed to be “transparent and unique” to fit individual institutions while allowing aggregated progress to be tracked and reported.

A UNEP FI press release highlights members’ dual goals of transitioning their investment portfolios to net zero GHG emissions by 2050, and achieving this through engaging on corporate action and public policies. Members do not seek to “engage in a divestment exercise,” rather they intend to engage with portfolio companies to assist them in adjusting their business models, UNEP FI notes.

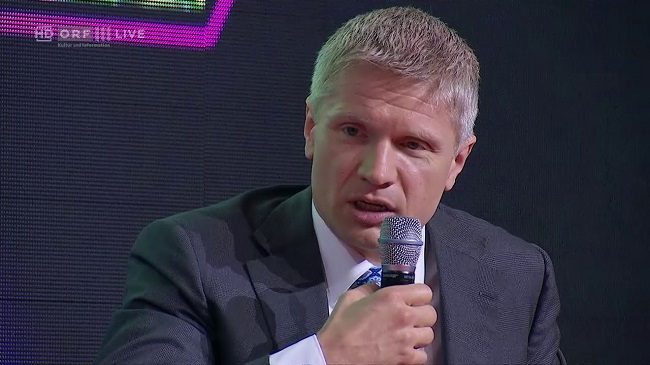

“Reaching net-zero is not simply reducing emissions and carrying on with the business models of today,” said Günther Thallinger, Alliance Chair and Member of the Board of Management, Allianz SE. “There are profound changes and opportunities that will come from the net-zero economy,” he noted, highlighting “new business opportunities and strong wins for those who are ready to lead.”

The Protocol is available for comment for one month, from October 13 till November 13.

Alliance members have also made commitments under other asset decarbonisation initiatives, including the UN Global Compact Business Ambition for 1.5°C, the Science Based Targets Initiative for Financial Institutions (SBTIFI), the Paris Aligned Investing Initiative (PAII) of the Institutional Investors Group on Climate Change (IIGCC), and the Investor Agenda Investor Climate Action Plans (ICAPs).

The draft protocol builds on the Net Zero Investment Framework, a draft investor guide for achieving net zero emissions by 2050, launched by the Institutional Investors Group on Climate Change (IIPGG) in August 2020. The Framework was developed with 70 leading global investors representing $16 trillion in assets.