Climate finance by Multilateral Development Banks (MDBs) for low-income and middle-income economies reached a new record of $60.7 billion in 2022, up 46 percent compared to 2019 volumes, a new joint report by the MDBs has found.

Of the amount, $38.0 billion, or 63%, went into climate change mitigation finance, and $22.7 billion or 37%, supported climate change adaptation. Mobilised private finance stood at $16.9 billion, the report said.

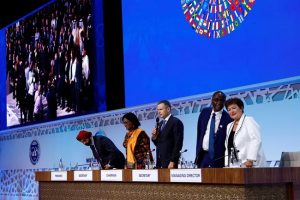

The announcement comes as delegates met in Marrakesh, Morocco, for the World Bank Group and International Monetary Fund Annual Meetings, where scaling up public climate finance, particularly for low and middle-income economies, ranks high on the agenda.

In 2022, MDBs allocated $38.8 billion to high-income economies. Of this, $36.3 billion, or 94%, was for climate change mitigation finance and $2.5 billion or 6%, went into climate change adaptation finance. The amount of mobilised private finance stood at $51.9 billion.

Surpassing climate finance targets

With the record 2022 climate finance volumes, multilateral development banks have, for the second year in a row, exceeded the 2025 climate finance targets they set themselves at the UN Secretary General’s Climate Action Summit in 2019. This included delivering a cumulative $50 billion in climate finance for low-income and middle-income economies, at least $65 billion globally, with an expected doubling in adaptation finance to $18 billion; and private mobilisation of $40 billion.

Compared to 2019 volumes, MDB 2022 climate finance for low and middle-income countries increased by 46% ($41.5 billion) and global climate finance by 62% ($61.6 billion).

For example, the African Development Bank’s climate finance investments increased from $2.1 billion in 2020 to $2.4 billion in 2021 and $3.6 billion in 2022. The Bank’s allocation is almost entirely channelled to low-income and middle-income economies.

The Bank Group’s Director for Climate Change and Green Growth Department, Anthony Nyong, said the institution recognises the urgency to mobilise climate finance at scale to address climate impacts and harness climate opportunities on the continent.

He said: “As shown in the report, external climate funds, including Climate Investment Fund, Global Environment Facility and Green Climate Fund, continue to be the main source of co-financing. More is needed from the private sector. The African Development Bank is committed to rallying domestic and global partners to de-risk private capital to unblock the needed trillions of climate finance for Africa.”

Transparent joint reporting on climate finance

The Joint Report on MDBs Climate Finance is an annual collaborative effort to publish climate finance figures, with a clear explanation of the methodologies for tracking progress concerning their joint climate targets, such as those announced at the UN Climate Change Conference in Paris (COP21) and the greater ambition pledged for the 2021-2025 period.

This year’s report incorporates the Council of Europe Development Bank and New Development Bank’s climate finance fully into the MDB reporting so that for the first time, all ten MDBs’ climate finance is included in the aggregated data reported. Even without the two MDBs joining the reporting, global climate finance rose to $98 billion in 2022. In addition, this year’s report includes a more detailed breakdown of MDB climate finance in least-developed countries and small island developing states.

The 2022 multilateral development bank report, coordinated by the European Investment Bank (EIB), combines data from the African Development Bank, the Asian Development Bank, the Asian Infrastructure Investment Bank, the Council of Europe Development Bank, the European Bank for Reconstruction and Development, the EIB, the Inter-American Development Bank Group, the Islamic Development Bank, the New Development Bank, and the World Bank.